[vc_row][vc_column][vc_column_text css_animation=”fadeInDown”]

Intel Corporation Announces Quarterly Dividend of $0.27 (NASDAQ:INTC)

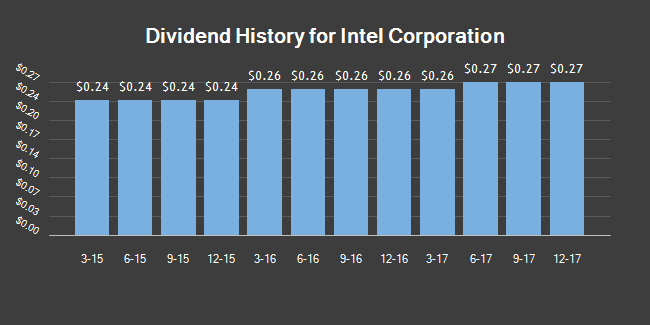

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_column_text css_animation=”fadeInLeft”]Intel Corporation (NASDAQ:INTC) announced a quarterly dividend on Thursday, September 14th, RTT News reports. Investors of record on Tuesday, November 7th will be given a dividend of 0.2725 per share by the chip maker on Friday, December 1st. This represents a $1.09 annualized dividend and a yield of 2.44%. The ex-dividend date of this dividend is Monday, November 6th.

Intel Corporation has raised its dividend payment by an average of 4.9% annually over the last three years and has increased its dividend annually for the last 2 consecutive years. Intel Corporation has a dividend payout ratio of 33.5% meaning its dividend is sufficiently covered by earnings. Equities analysts expect Intel Corporation to earn $3.28 per share next year, which means the company should continue to be able to cover its $1.09 annual dividend with an expected future payout ratio of 33.2%.

Shares of Intel Corporation (INTC) traded down $0.01 during trading hours on Monday, hitting $44.62. 22,418,533 shares of the company’s stock were exchanged, compared to its average volume of 23,630,906. The firm has a market capitalization of $209,220.00, a PE ratio of 14.03, a price-to-earnings-growth ratio of 1.63 and a beta of 1.09. The company has a quick ratio of 1.27, a current ratio of 1.60 and a debt-to-equity ratio of 0.39. Intel Corporation has a 52 week low of $33.23 and a 52 week high of $47.30.[/vc_column_text][/vc_column][vc_column width=”1/2″][vc_raw_html]JTNDJTIxLS0lMjBUcmFkaW5nVmlldyUyMFdpZGdldCUyMEJFR0lOJTIwLS0lM0UlMEElM0NzY3JpcHQlMjB0eXBlJTNEJTIydGV4dCUyRmphdmFzY3JpcHQlMjIlMjBzcmMlM0QlMjJodHRwcyUzQSUyRiUyRnMzLnRyYWRpbmd2aWV3LmNvbSUyRnR2LmpzJTIyJTNFJTNDJTJGc2NyaXB0JTNFJTBBJTNDc2NyaXB0JTIwdHlwZSUzRCUyMnRleHQlMkZqYXZhc2NyaXB0JTIyJTNFJTBBbmV3JTIwVHJhZGluZ1ZpZXcud2lkZ2V0JTI4JTdCJTBBJTIwJTIwJTIyd2lkdGglMjIlM0ElMjA2MDAlMkMlMEElMjAlMjAlMjJoZWlnaHQlMjIlM0ElMjAzODAlMkMlMEElMjAlMjAlMjJzeW1ib2wlMjIlM0ElMjAlMjJJTlRDJTIyJTJDJTBBJTIwJTIwJTIyaW50ZXJ2YWwlMjIlM0ElMjAlMjJEJTIyJTJDJTBBJTIwJTIwJTIydGltZXpvbmUlMjIlM0ElMjAlMjJFdGMlMkZVVEMlMjIlMkMlMEElMjAlMjAlMjJ0aGVtZSUyMiUzQSUyMCUyMkxpZ2h0JTIyJTJDJTBBJTIwJTIwJTIyc3R5bGUlMjIlM0ElMjAlMjIxJTIyJTJDJTBBJTIwJTIwJTIybG9jYWxlJTIyJTNBJTIwJTIyZW4lMjIlMkMlMEElMjAlMjAlMjJ0b29sYmFyX2JnJTIyJTNBJTIwJTIyJTIzZjFmM2Y2JTIyJTJDJTBBJTIwJTIwJTIyZW5hYmxlX3B1Ymxpc2hpbmclMjIlM0ElMjBmYWxzZSUyQyUwQSUyMCUyMCUyMmhpZGVfc2lkZV90b29sYmFyJTIyJTNBJTIwZmFsc2UlMkMlMEElMjAlMjAlMjJhbGxvd19zeW1ib2xfY2hhbmdlJTIyJTNBJTIwdHJ1ZSUyQyUwQSUyMCUyMCUyMmhpZGVpZGVhcyUyMiUzQSUyMHRydWUlMEElN0QlMjklM0IlMEElM0MlMkZzY3JpcHQlM0UlMEElM0MlMjEtLSUyMFRyYWRpbmdWaWV3JTIwV2lkZ2V0JTIwRU5EJTIwLS0lM0UlMEElMEE=[/vc_raw_html][vc_raw_html]JTNDY2VudGVyJTNFJTBBJTNDc2NyaXB0JTIwYXN5bmMlMjBzcmMlM0QlMjIlMkYlMkZwYWdlYWQyLmdvb2dsZXN5bmRpY2F0aW9uLmNvbSUyRnBhZ2VhZCUyRmpzJTJGYWRzYnlnb29nbGUuanMlMjIlM0UlM0MlMkZzY3JpcHQlM0UlMEElM0MlMjEtLSUyMFNjYWxwJTIwcmVkJTIwYXV0byUyMC0tJTNFJTBBJTNDaW5zJTIwY2xhc3MlM0QlMjJhZHNieWdvb2dsZSUyMiUyMCUyMCUyMCUyMHN0eWxlJTNEJTIyZGlzcGxheSUzQWJsb2NrJTIyJTBBJTIwJTIwJTIwJTIwJTIwZGF0YS1hZC1jbGllbnQlM0QlMjJjYS1wdWItMjkwNTE4MjMzOTAwMjg5MCUyMiUwQSUyMCUyMCUyMCUyMCUyMGRhdGEtYWQtc2xvdCUzRCUyMjk1NDA1MjcyMzElMjIlMEElMjAlMjAlMjAlMjAlMjBkYXRhLWFkLWZvcm1hdCUzRCUyMmF1dG8lMjIlM0UlM0MlMkZpbnMlM0UlMEElM0NzY3JpcHQlM0UlMEElMjhhZHNieWdvb2dsZSUyMCUzRCUyMHdpbmRvdy5hZHNieWdvb2dsZSUyMCU3QyU3QyUyMCU1QiU1RCUyOS5wdXNoJTI4JTdCJTdEJTI5JTNCJTBBJTNDJTJGc2NyaXB0JTNFJTBBJTNDJTJGY2VudGVyJTNF[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text css_animation=”fadeIn”]Intel Corporation (NASDAQ:INTC) last posted its quarterly earnings data on Thursday, October 26th. The chip maker reported $1.01 earnings per share for the quarter, beating the Thomson Reuters’ consensus estimate of $0.80 by $0.21. Intel Corporation had a net margin of 22.31% and a return on equity of 22.65%. The company had revenue of $16.15 billion during the quarter, compared to analyst estimates of $15.73 billion. During the same quarter last year, the firm posted $0.80 EPS. The business’s revenue for the quarter was up 2.4% on a year-over-year basis. sell-side analysts predict that Intel Corporation will post 3.25 earnings per share for the current fiscal year.

INTC has been the topic of several recent research reports. Zacks Investment Research lowered shares of Intel Corporation from a “buy” rating to a “hold” rating in a research report on Wednesday, August 16th. Canaccord Genuity raised their price objective on shares of Intel Corporation from $41.00 to $45.00 and gave the stock a “hold” rating in a research note on Friday. ValuEngine downgraded shares of Intel Corporation from a “buy” rating to a “hold” rating in a research note on Friday, September 1st. Goldman Sachs Group, Inc. (The) reiterated a “hold” rating and set a $39.00 price target on shares of Intel Corporation in a research note on Monday, July 31st. Finally, BidaskClub raised Intel Corporation from a “hold” rating to a “buy” rating in a report on Thursday, August 10th. Five equities research analysts have rated the stock with a sell rating, thirteen have issued a hold rating, twenty-seven have issued a buy rating and one has assigned a strong buy rating to the company. Intel Corporation presently has an average rating of “Buy” and an average target price of $43.40.

In other Intel Corporation news, EVP Diane M. Bryant sold 1,639 shares of the stock in a transaction on Tuesday, October 24th. The stock was sold at an average price of $40.91, for a total transaction of $67,051.49. Following the sale, the executive vice president now directly owns 113,086 shares in the company, valued at approximately $4,626,348.26. The sale was disclosed in a document filed with the SEC, which is accessible through the SEC website. Also, CEO Brian M. Krzanich sold 61,860 shares of the stock in a transaction on Monday, October 2nd. The shares were sold at an average price of $38.74, for a total value of $2,396,456.40. Following the transaction, the chief executive officer now directly owns 543,948 shares in the company, valued at $21,072,545.52. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 659,036 shares of company stock worth $28,872,880. Company insiders own 0.08% of the company’s stock.

A number of institutional investors have recently made changes to their positions in the stock. Public Employees Retirement System of Ohio raised its holdings in Intel Corporation by 0.3% during the second quarter. Public Employees Retirement System of Ohio now owns 3,456,142 shares of the chip maker’s stock valued at $116,610,000 after acquiring an additional 9,165 shares during the period. Koch Industries Inc. raised its holdings in Intel Corporation by 7,849.4% during the second quarter. Koch Industries Inc. now owns 782,935 shares of the chip maker’s stock valued at $760,000 after acquiring an additional 773,086 shares during the period. First Fiduciary Investment Counsel Inc. raised its holdings in Intel Corporation by 37.9% during the second quarter. First Fiduciary Investment Counsel Inc. now owns 634,658 shares of the chip maker’s stock valued at $21,413,000 after acquiring an additional 174,485 shares during the period. High Falls Advisors Inc raised its holdings in Intel Corporation by 4.2% during the second quarter. High Falls Advisors Inc now owns 10,550 shares of the chip maker’s stock valued at $356,000 after acquiring an additional 427 shares during the period. Finally, Verition Fund Management LLC raised its holdings in Intel Corporation by 173.0% during the second quarter. Verition Fund Management LLC now owns 39,901 shares of the chip maker’s stock valued at $1,346,000 after acquiring an additional 25,286 shares during the period. 66.90% of the stock is currently owned by institutional investors.[/vc_column_text][vc_raw_html]JTNDY2VudGVyJTNFJTBBJTNDc2NyaXB0JTIwYXN5bmMlMjBzcmMlM0QlMjIlMkYlMkZwYWdlYWQyLmdvb2dsZXN5bmRpY2F0aW9uLmNvbSUyRnBhZ2VhZCUyRmpzJTJGYWRzYnlnb29nbGUuanMlMjIlM0UlM0MlMkZzY3JpcHQlM0UlMEElM0MlMjEtLSUyMEJsdWUlMjBiYW5uZXIlMjAtLSUzRSUwQSUzQ2lucyUyMGNsYXNzJTNEJTIyYWRzYnlnb29nbGUlMjIlMEElMjAlMjAlMjAlMjAlMjBzdHlsZSUzRCUyMmRpc3BsYXklM0FpbmxpbmUtYmxvY2slM0J3aWR0aCUzQTk3MHB4JTNCaGVpZ2h0JTNBMjUwcHglMjIlMEElMjAlMjAlMjAlMjAlMjBkYXRhLWFkLWNsaWVudCUzRCUyMmNhLXB1Yi0yOTA1MTgyMzM5MDAyODkwJTIyJTBBJTIwJTIwJTIwJTIwJTIwZGF0YS1hZC1zbG90JTNEJTIyOTU2NzcwOTYzMSUyMiUzRSUzQyUyRmlucyUzRSUwQSUzQ3NjcmlwdCUzRSUwQSUyOGFkc2J5Z29vZ2xlJTIwJTNEJTIwd2luZG93LmFkc2J5Z29vZ2xlJTIwJTdDJTdDJTIwJTVCJTVEJTI5LnB1c2glMjglN0IlN0QlMjklM0IlMEElM0MlMkZzY3JpcHQlM0UlMEElM0MlMkZjZW50ZXIlM0U=[/vc_raw_html][/vc_column][/vc_row]