[vc_row][vc_column][vc_column_text css_animation=”fadeInDown”]

How Does OptimumBank Holdings Inc (OPHC) Compare To The Financial Sector?

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column width=”1/2″][vc_column_text css_animation=”fadeInLeft”]

OptimumBank Holdings Inc (NASDAQ:OPHC), a USD$2.28M small-cap, operates in the banking industry, which now face the choice of either being disintermediated or proactively disrupting their own business models to thrive in the future. Financial services analysts are forecasting for the entire industry, a strong double-digit growth of 11.06% in the upcoming year , and a whopping growth of 45.21% over the next couple of years. This rate is larger than the growth rate of the US stock market as a whole. Today, I will analyse the industry outlook, as well as evaluate whether OPHC is lagging or leading in the industry. View our latest analysis for OptimumBank Holdings

What’s the catalyst for OPHC’s sector growth?

[/vc_column_text][/vc_column][vc_column width=”1/2″][vc_raw_html]JTNDY2VudGVyJTNFJTBBJTNDc2NyaXB0JTIwYXN5bmMlMjBzcmMlM0QlMjIlMkYlMkZwYWdlYWQyLmdvb2dsZXN5bmRpY2F0aW9uLmNvbSUyRnBhZ2VhZCUyRmpzJTJGYWRzYnlnb29nbGUuanMlMjIlM0UlM0MlMkZzY3JpcHQlM0UlMEElM0MlMjEtLSUyMFNjYWxwJTIwcmVkJTIwYXV0byUyMC0tJTNFJTBBJTNDaW5zJTIwY2xhc3MlM0QlMjJhZHNieWdvb2dsZSUyMiUyMCUyMCUyMCUyMHN0eWxlJTNEJTIyZGlzcGxheSUzQWJsb2NrJTIyJTBBJTIwJTIwJTIwJTIwJTIwZGF0YS1hZC1jbGllbnQlM0QlMjJjYS1wdWItMjkwNTE4MjMzOTAwMjg5MCUyMiUwQSUyMCUyMCUyMCUyMCUyMGRhdGEtYWQtc2xvdCUzRCUyMjk1NDA1MjcyMzElMjIlMEElMjAlMjAlMjAlMjAlMjBkYXRhLWFkLWZvcm1hdCUzRCUyMmF1dG8lMjIlM0UlM0MlMkZpbnMlM0UlMEElM0NzY3JpcHQlM0UlMEElMjhhZHNieWdvb2dsZSUyMCUzRCUyMHdpbmRvdy5hZHNieWdvb2dsZSUyMCU3QyU3QyUyMCU1QiU1RCUyOS5wdXNoJTI4JTdCJTdEJTI5JTNCJTBBJTNDJTJGc2NyaXB0JTNFJTBBJTNDJTJGY2VudGVyJTNF[/vc_raw_html][vc_raw_html]JTNDJTIxLS0lMjBUcmFkaW5nVmlldyUyMFdpZGdldCUyMEJFR0lOJTIwLS0lM0UlMEElM0NzY3JpcHQlMjB0eXBlJTNEJTIydGV4dCUyRmphdmFzY3JpcHQlMjIlMjBzcmMlM0QlMjJodHRwcyUzQSUyRiUyRnMzLnRyYWRpbmd2aWV3LmNvbSUyRnR2LmpzJTIyJTNFJTNDJTJGc2NyaXB0JTNFJTBBJTNDc2NyaXB0JTIwdHlwZSUzRCUyMnRleHQlMkZqYXZhc2NyaXB0JTIyJTNFJTBBbmV3JTIwVHJhZGluZ1ZpZXcud2lkZ2V0JTI4JTdCJTBBJTIwJTIwJTIyd2lkdGglMjIlM0ElMjA2MDAlMkMlMEElMjAlMjAlMjJoZWlnaHQlMjIlM0ElMjA0MDAlMkMlMEElMjAlMjAlMjJzeW1ib2wlMjIlM0ElMjAlMjJPUEhDJTIyJTJDJTBBJTIwJTIwJTIyaW50ZXJ2YWwlMjIlM0ElMjAlMjJEJTIyJTJDJTBBJTIwJTIwJTIydGltZXpvbmUlMjIlM0ElMjAlMjJFdGMlMkZVVEMlMjIlMkMlMEElMjAlMjAlMjJ0aGVtZSUyMiUzQSUyMCUyMkxpZ2h0JTIyJTJDJTBBJTIwJTIwJTIyc3R5bGUlMjIlM0ElMjAlMjIxJTIyJTJDJTBBJTIwJTIwJTIybG9jYWxlJTIyJTNBJTIwJTIyZW4lMjIlMkMlMEElMjAlMjAlMjJ0b29sYmFyX2JnJTIyJTNBJTIwJTIyJTIzZjFmM2Y2JTIyJTJDJTBBJTIwJTIwJTIyZW5hYmxlX3B1Ymxpc2hpbmclMjIlM0ElMjBmYWxzZSUyQyUwQSUyMCUyMCUyMmhpZGVfc2lkZV90b29sYmFyJTIyJTNBJTIwZmFsc2UlMkMlMEElMjAlMjAlMjJhbGxvd19zeW1ib2xfY2hhbmdlJTIyJTNBJTIwdHJ1ZSUyQyUwQSUyMCUyMCUyMmhpZGVpZGVhcyUyMiUzQSUyMHRydWUlMEElN0QlMjklM0IlMEElM0MlMkZzY3JpcHQlM0UlMEElM0MlMjEtLSUyMFRyYWRpbmdWaWV3JTIwV2lkZ2V0JTIwRU5EJTIwLS0lM0UlMEElMEE=[/vc_raw_html][vc_raw_html]JTNDY2VudGVyJTNFJTBBJTNDc2NyaXB0JTIwYXN5bmMlMjBzcmMlM0QlMjIlMkYlMkZwYWdlYWQyLmdvb2dsZXN5bmRpY2F0aW9uLmNvbSUyRnBhZ2VhZCUyRmpzJTJGYWRzYnlnb29nbGUuanMlMjIlM0UlM0MlMkZzY3JpcHQlM0UlMEElM0MlMjEtLSUyMFNjYWxwJTIwcmVkJTIwYXV0byUyMC0tJTNFJTBBJTNDaW5zJTIwY2xhc3MlM0QlMjJhZHNieWdvb2dsZSUyMiUyMCUyMCUyMCUyMHN0eWxlJTNEJTIyZGlzcGxheSUzQWJsb2NrJTIyJTBBJTIwJTIwJTIwJTIwJTIwZGF0YS1hZC1jbGllbnQlM0QlMjJjYS1wdWItMjkwNTE4MjMzOTAwMjg5MCUyMiUwQSUyMCUyMCUyMCUyMCUyMGRhdGEtYWQtc2xvdCUzRCUyMjk1NDA1MjcyMzElMjIlMEElMjAlMjAlMjAlMjAlMjBkYXRhLWFkLWZvcm1hdCUzRCUyMmF1dG8lMjIlM0UlM0MlMkZpbnMlM0UlMEElM0NzY3JpcHQlM0UlMEElMjhhZHNieWdvb2dsZSUyMCUzRCUyMHdpbmRvdy5hZHNieWdvb2dsZSUyMCU3QyU3QyUyMCU1QiU1RCUyOS5wdXNoJTI4JTdCJTdEJTI5JTNCJTBBJTNDJTJGc2NyaXB0JTNFJTBBJTNDJTJGY2VudGVyJTNF[/vc_raw_html][/vc_column][/vc_row][vc_row][vc_column][vc_column_text css_animation=”fadeIn”]

There is a growing awareness that banks cannot excel at every activity, and that it may be easier and cheaper to outsource noncore activities. However, the threat of disintermediation in the payments industry is both real and imminent, taking profits away from traditional incumbent financial institutions. In the past year, the industry delivered growth in the teens, beating the US market growth of 10.30%. OPHC lags the pack with its sustained negative earnings over the past couple of years. The company’s outlook seems uncertain, with a lack of analyst coverage, which doesn’t boost our confidence in the stock. This lack of growth and transparency means OPHC may be trading cheaper than its peers.

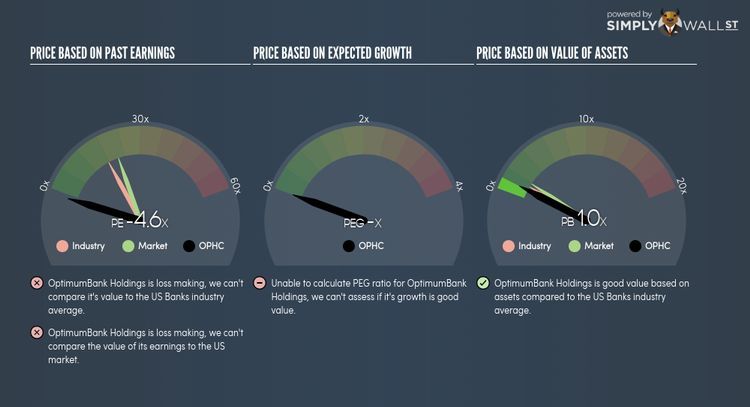

Is OPHC and the sector relatively cheap?

The banking industry is trading at a PE ratio of 18x, relatively similar to the rest of the US stock market PE of 22x. This illustrates a fairly valued sector relative to the rest of the market, indicating low mispricing opportunities. Furthermore, the industry returned a similar 8.95% on equities compared to the market’s 10.06%. Since OPHC’s earnings doesn’t seem to reflect its true value, its PE ratio isn’t very useful. A loose alternative to gauge OPHC’s value is to assume the stock should be relatively in-line with its industry.

What this means for you:

Are you a shareholder? OPHC has been a banking industry laggard in the past year. If your initial investment thesis is around the growth prospects of OPHC, there are other banking companies that have delivered higher growth, and perhaps trading at a discount to the industry average. Consider how OPHC fits into your wider portfolio and the opportunity cost of holding onto the stock.

Are you a potential investor? If OPHC has been on your watchlist for a while, now may be a good time to dig deeper into the stock. Although its growth has delivered lower growth relative to its banking peers in the near term, the market may be pessimistic on the stock, leading to a potential undervaluation. Before you make a decision on the stock, I suggest you look at OPHC’s future cash flows in order to assess whether the stock is trading at a reasonable price.

[/vc_column_text][vc_raw_html]JTNDY2VudGVyJTNFJTBBJTNDc2NyaXB0JTIwYXN5bmMlMjBzcmMlM0QlMjIlMkYlMkZwYWdlYWQyLmdvb2dsZXN5bmRpY2F0aW9uLmNvbSUyRnBhZ2VhZCUyRmpzJTJGYWRzYnlnb29nbGUuanMlMjIlM0UlM0MlMkZzY3JpcHQlM0UlMEElM0MlMjEtLSUyMEJsdWUlMjBiYW5uZXIlMjAtLSUzRSUwQSUzQ2lucyUyMGNsYXNzJTNEJTIyYWRzYnlnb29nbGUlMjIlMEElMjAlMjAlMjAlMjAlMjBzdHlsZSUzRCUyMmRpc3BsYXklM0FpbmxpbmUtYmxvY2slM0J3aWR0aCUzQTk3MHB4JTNCaGVpZ2h0JTNBMjUwcHglMjIlMEElMjAlMjAlMjAlMjAlMjBkYXRhLWFkLWNsaWVudCUzRCUyMmNhLXB1Yi0yOTA1MTgyMzM5MDAyODkwJTIyJTBBJTIwJTIwJTIwJTIwJTIwZGF0YS1hZC1zbG90JTNEJTIyOTU2NzcwOTYzMSUyMiUzRSUzQyUyRmlucyUzRSUwQSUzQ3NjcmlwdCUzRSUwQSUyOGFkc2J5Z29vZ2xlJTIwJTNEJTIwd2luZG93LmFkc2J5Z29vZ2xlJTIwJTdDJTdDJTIwJTVCJTVEJTI5LnB1c2glMjglN0IlN0QlMjklM0IlMEElM0MlMkZzY3JpcHQlM0UlMEElM0MlMkZjZW50ZXIlM0U=[/vc_raw_html][/vc_column][/vc_row]